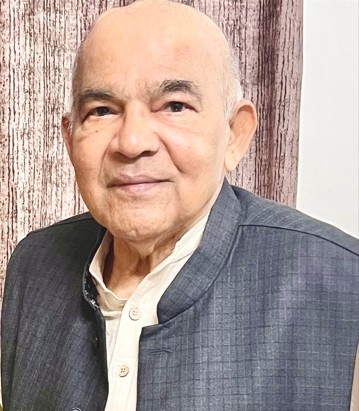

Dr. Y Venugopal Reddy Distinguished Fellow

Dr. Y Venugopal Reddy

Distinguished Fellow

Area:

Financial Sector Reforms, Economic Stability, Monetary Policy, Financial Inclusion

Qualification:

M.A. in Economics from Madras University, India

Ph.D. from Osmania University, Hyderabad.

Diploma in Economic Planning from the Institute of Social Studies, The Netherlands

- Education

Dr. Yaga Venugopal Reddy, better known as Dr. Y.V. Reddy received his M.A. in economics from Madras University, India. He holds a Ph.D. from Osmania University, Hyderabad. He also holds a Diploma in Economic Planning from the Institute of Social Studies, The Netherlands

- Previous Position

In 1996, Reddy had been appointed deputy governor of RBI. He has also worked with the International Monetary Fund as executive director in 2002. Prior to joining the Indian Administrative Services (IAS), he worked as a lecturer from 1961.

While in the IAS, he held the positions of secretary (banking) in Ministry of Finance and principal secretary in Government of Andhra Pradesh and has worked with the governments of China, Bahrain, Ethiopia and Tanzania.

Reddy was Member of The Commission of Experts of the president of the UN General Assembly on Reforms of International Monetary and Financial System. In addition to the chair, Professor Joseph Stiglitz (USA), members of this UN Commission were drawn from Japan, Western Europe, Africa, Latin America, South and East Asia.

Reddy was president of the Indian Econometric Society during 2011. Reddy was on the advisory board of Institute for New Economic Thinking (INET). The INET advisory board includes Nobel laureates as well as other prominent economists.

Reddy was on International Advisory Board of the Columbia Program on Indian Economic Policies, Columbia University, New York. He was a Member of an informal international group of prominent persons on International Monetary Reforms. He was also on Advisory Group of eminent persons to advise the finance minister of India on G-20 issues.

He was the chairman of the Fourteenth Finance Commission of India since 3 January 2013 and served there till 25 November 2017.

Reddy was appointed the twenty-first governor of the Reserve Bank of India on 6 September 2003 and served in that position for five years.

- Books & Publications

- ADVICE & DISSENT My Life in Public Service Published by Harper Collins India, 2017.

- Financial and Fiscal Policies – Crises and New Realities Published by Oxford University Press, 2014

- ECONOMIC POLICIES and INDIA’S REFORM AGENDA NEW THINKING Published by Orient Black Swan, 2013

- GLOBAL CRISIS, RECESSION AND UNEVEN RECOVERY by Orient BlackSwan, 2011

- INDIA AND THE GLOBAL FINANCIAL CRISIS Managing Money and Finance Published by Orient Black Swan, 2009

- ECONOMIC POLICY IN INDIA Managing Change Published by UBS Publishers’ Distributors Pvt. Ltd. In 2003

- Lectures on ECONOMIC and FINANCIAL SECTOR REFORMS In India Published by Oxford University Press In 2002

- PUBLIC ENTERPRISE REFORM AND PRIVATISATION Published by Himalaya Publishing House in 1992

- PRIVATISATION Approaches, Processes and Issues Published by Galgotia Publications in 1992

- WORLD BANK Borrowers’ Perspectives Published by Sterling Publishers Private Limited In 1985

- MULTILEVEL PLANNING IN INDIA Published by VIKAS PUBLISHING HOUSE PVT. LTD. in 1979

- Awards & Recognitions

- Dr. Reddy was the Conference President of the 97th Annual Conference of the Indian Economic Association in 2014. Earlier, during 2011, he was President of Indian Econometric Society. In 2010, President of India awarded India’s second highest civilian honour, the Padma Vibhushan to Dr. Reddy. Dr. Y.V. Reddy, was the 21st Governor of the Reserve bank of India from 2003-2008 and the Chairman of the Fourteenth Finance Commission of India from 1st Feb. 2013 to 31st December 2014.

- On 17 July 2008, Dr. Reddy was made an Honorary Fellow of the London School of Economics. Earlier, he was awarded Doctor of Letters (Honoris Causa) by Sri Venkateswara University, India; and Doctor of Civil Law (Honoris Causa) by the University of Mauritius.

- Other Information

Reddy has worked on piloting a calibrated approach to financial sector reforms.

A 19 December 2008 article in the New York Times has credited the tough lending standards he imposed on the Indian banks as RBI Governor for saving the Indian banking system from the sub-prime and liquidity crisis of 2008.

At the Reserve Bank, he was Member-Secretary of two high level committees chaired by RBI governor Dr. C. Rangarajan: one on Balance of payments and the other on Public Sector disinvestments.

Reddy was also a member of the Reserve Bank of India’s Policy Group on External Debt Statistics. Reddy is credited to have played a crucial role in framing macro-economic policies that helped quarantine the country from the domino effect of the financial crisis encountered by the South-East Asian countries during the later part of the 1990s. He, along with Dr. C. Rangarajan, is also credited with the formulation of the course to be steered by the country to come out of the then Balance of Payments crisis.

In the Indian context, he was the first to use the term ‘financial inclusion’ in April 2005 in his Annual Policy Statement as Governor of the Reserve Bank of India. Banks were urged in the Annual Policy Statement to review their existing practices to align them with the objective of financial inclusion.

As Governor, he saw his job as making sure Indian banks did not get too caught up in the bubble mentality. He banned the use of bank loans for the purchase of raw land, and sharply curtailed securitisations and derivatives, and essentially prohibited off-balance sheet financing. He increased risk weightings on commercial buildings and shopping mall construction and increased bank reserve requirements.

In one of his interview, Joseph E. Stiglitz, Professor of Economics at Columbia University and Nobel Laureate, had said ‘If America had a central bank chief like Y.V. Reddy, the US economy would not have been in such a mess.’

Less well-discussed is his work on rural banking, particularly on reviving co-operative banks and his focus on the common person. His term was marked by an emphasis on financial inclusion with the aid of information technology. He is widely consulted on many financial issues by institutions both in India as well as the world over.

23 speeches given by Reddy during his term as RBI governor (2003 to 2008) are in the public domain. Other speeches are also in the public domain, for example:

Capital Flows and Self Reliance Redefined (Speech). Twenty Seventh Frank Moraes Lecture. Chennai, India. 13 July 2000.

A Tale of Two Commissions and Missing Links (Speech). Indian Economic Association 97th Annual Conference. Udaipur, India. 27 December 2014.

Society, Economic Policies, and the Financial Sector (Speech). The Per Jacobsson Foundation Lecture. Basel, Switzerland. 24 June 2012.

Monetary and Regulatory Policies:How to Get the Balance with Markets Right (Speech). As a panelist at the AGM panel of the Bank for International Settlements. Basel, Switzerland. 29 June 2008.

Reddy’s presidential address on “A Tale of Two Commissions and Missing Links” at the 97th Annual Conference of the Indian Economic Association (IEA) in Udaipur on 27 December 2014, dwelt at length on the origin, evolution, linkages, achievements, limitations and the debates relating to the two major commissions on economic affairs in India. He also cited the success of the Chinese model where the concept of ‘plan’ had been replaced by ‘guideline’ in the country’s 11th Five Year programme. He noted “The change led to China’s transition from a Soviet-style planned economy to a socialist market economy and gained greater responsibility and power in overseeing China’s economic development”.

Reddy was invited to deliver the prestigious The Per Jacobsson Foundation Lecture in June 2012 at the Bank for International Settlements in Switzerland. In this lecture on ‘Society, Economic Policies and the Financial Sector’, the main message he gave was that society has put its trust in central banks and as such it expects central bank to ensure trust and confidence in money and finance and serve the interest of the masses.